Meme coin hype cycles describe the phenomenon where cryptocurrencies inspired by internet memes frequently experience dizzying price surges followed by sharp crashes. Understanding the stages, driving factors, and inherent risks of these characteristic cycles is crucial for anyone interested in this highly volatile asset class, often driven more by sentiment than fundamentals.

What are meme coins?

Before diving into hype cycles, let’s clarify the concept of meme coins. These are a type of cryptocurrency often created based on popular internet memes, jokes, or cultural phenomena. Names like Dogecoin (inspired by the Shiba Inu dog meme) or Shiba Inu (self-proclaimed “Dogecoin killer”) are typical examples.

Unlike major cryptocurrencies like Bitcoin or Ethereum, which often have specific technological goals or applications, meme coins initially tend to lack clear intrinsic value or practical use cases. Their main strength lies in their supportive communities, social media virality, and the element of “fun” or entertainment.

What are meme coin hype cycles?

Meme coin hype cycles describe the characteristic price movement pattern of these coins: rapid, explosive growth reaching a peak of excitement (hype), followed by a sharp and often prolonged decline. This pattern isn’t unique in financial markets, but it is particularly pronounced and intense for meme coins due to their highly speculative nature and significant influence from crowd psychology.

Understanding the stages of meme coin hype cycles can help investors identify potential opportunities and, more importantly, avoid potential pitfalls.

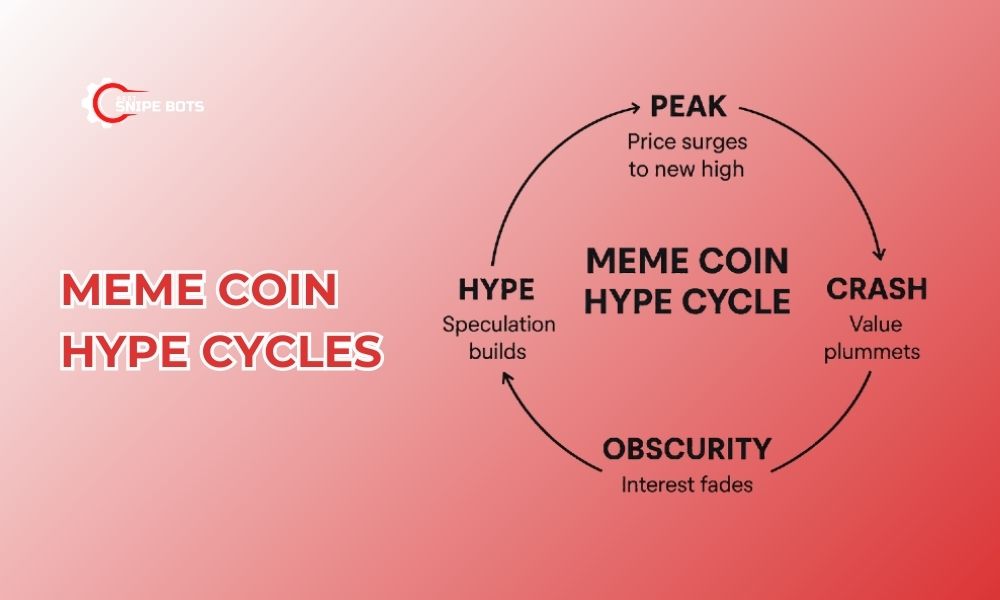

The main stages of a meme coin hype cycle (following the Hype -> Peak -> Crash -> Obscurity model):

A typical meme coin hype cycle often progresses through four distinct stages, forming a loop of attention, speculation, climax, and decline:

Hype stage:

This is when attention and speculation begin to build around a specific meme coin (“Speculation builds”).

Information spreads rapidly across social media platforms like Twitter, Reddit, and TikTok, often fueled by influencers or online communities.

Fear Of Missing Out (FOMO) starts to set in, causing more investors to jump in, fearing they’ll miss out on quick profits. The price begins to rise, attracting further attention. This stage kicks off the explosive phase of the meme coin hype cycles.

Peak stage:

Hype and optimism reach extreme levels. The meme coin is talked about everywhere, and the belief that the price will continue to skyrocket (“to the moon!”) becomes widespread.

The price surges dramatically, continuously breaking new highs and reaching the cycle’s apex (“Price surges to new high”). Trading volume is typically immense.

This stage is extremely dangerous for late buyers, as the market is often overbought, and the euphoric sentiment is usually unsustainable.

Crash stage:

After peaking, selling pressure begins to mount significantly. Early buyers, large investors (“whales”), or those sensing a reversal start taking profits en masse.

The meme coin’s value starts to plummet rapidly and suddenly (“Value plummets”).

The price drop triggers panic selling from those who bought near the top or fear losing their entire investment. Negative news and FUD (Fear, Uncertainty, Doubt) often spread widely during this phase, exacerbating the decline.

Obscurity stage:

Following the crash, market and public interest in the meme coin sharply declines and fades away (“Interest fades”).

The price may stabilize at a very low level compared to the peak, trade sideways, or continue to bleed slowly. Trading volume becomes very low (poor liquidity).

The coin might be completely forgotten, becoming a “dead coin.” A few might survive tenuously thanks to a small, loyal community or potentially await a new catalyst to restart the meme coin hype cycle, although this is often unlikely.

Understanding these stages can help investors recognize the risks and avoid making emotionally driven decisions during volatile meme coin hype cycles.

What factors drive meme coin hype cycles?

Social media and influencers: This is the primary driver. A tweet from a famous person or a viral campaign on TikTok can make or break a meme coin.

Community power: Online communities (on Reddit, Discord, Telegram, etc.) play a vital role in promotion, maintaining morale, and generating hype.

FOMO and FUD: Crowd psychology is central. The fear of missing out on riches (FOMO) pushes prices up, while fear, uncertainty, and doubt (FUD) pull them down.

Media coverage: Attention from news outlets, both mainstream and niche, can amplify the hype.

Simplicity and accessibility: Buying and selling meme coins is often easier than dealing with more complex assets, attracting many new investors.

Massive profit potential (and corresponding risk): The allure of turning a small investment into a fortune overnight is very strong.

Advice for investors:

Participating in meme coin hype cycles is like a high-stakes gamble. If you decide to get involved:

- Do Your Own Research (DYOR): Learn about the project, the development team (if known), the community, and price history.

- Only invest money you are prepared to lose: This is the golden rule. Never use savings, borrowed money, or funds needed for essential expenses to buy meme coins.

- Understand the risks: Be aware that you could lose your entire investment.

- Avoid FOMO: Don’t buy just because the price is rising sharply or you fear missing out.

- Be wary of social media advice: Many people might be promoting coins for personal gain.

- Consider a profit-taking strategy: If you are lucky enough to make a profit, consider selling a portion to recover your initial investment or realize gains.

Meme coin hype cycles are a complex phenomenon, driven more by crowd psychology and social media dynamics than by underlying fundamentals. Dramatic price surges followed by sharp crashes are commonplace. Investors need to exercise extreme caution, conduct thorough research, and be fully aware of the risks before participating. Don’t forget, the meme coin market is highly unpredictable and fraught with pitfalls. Keep following Best Snipe Bots for more insightful analysis and useful information about the volatile world of cryptocurrency!